Learn how the best investors in the world are leveraging data & AI to become more efficient, effective, and inclusive to identify the most promising deals at the right time and propel their portfolio companies forward.This report has mapped 190 data-driven VC firms and 100 thought leaders across the globe to provide the most important insights and tangible steps to become more data-driven.We are also launching “The Lab”, a platform that includes content, products & tools, and community channels to access everything you need to run a modern investment firm in one place.

Join our free community to

access the report and all resources

01.

Why should VCs become

more data-driven?

The VC investment process is broken: across the value chain VCs are rifled with manual, inefficient, and non-inclusive processes. Data-driven initiatives have been shown to help funds of different stages in three main characteristics, Efficiency, Effectiveness, and Inclusiveness.

(1) Efficiency

DDVCs can leverage productivity gains to not incur further team expansion costs while exponentially increasing output to input ratio of the fund and its processes while focusing on spending time on more valued added actions.Beyond theory, data speaks in practice: Research demonstrates a significant productivity gain of 0.8 standard deviations when leveraging AI. This translates to demonstrably faster task completion, alongside a 0.4 standard deviation improvement in output quality (source).Furthermore, AI fosters a more level playing field by mitigating performance gaps between high and low-ability teams.

(2) Effectiveness

Venture capital is based on finding the needle in a haystack of good investment opportunities.Missing out on outliers costs funds their returns.VC fund returns are very concentrated, only 5% of funds return more than 3x of funds (source), and a significant way of piercing the VC flywheel and making it into top tier performers is by leveraging data-driven initiatives & AI to cut through the noise.

(3) Inclusiveness

Talent is distributed equally, capital is not.Biased selection processes misallocate capital and lower returns.Funding in relation to population is 43x, 52x, and 380x higher in North America in relation to MENA, LATAM, and Africa, respectively.Access to resources matters - top performing children are more likely to become inventors, but only if they come from high income families. Lastly, only 20% of inventors are female, and differences in ability do not explain the difference.

02.

Why now?

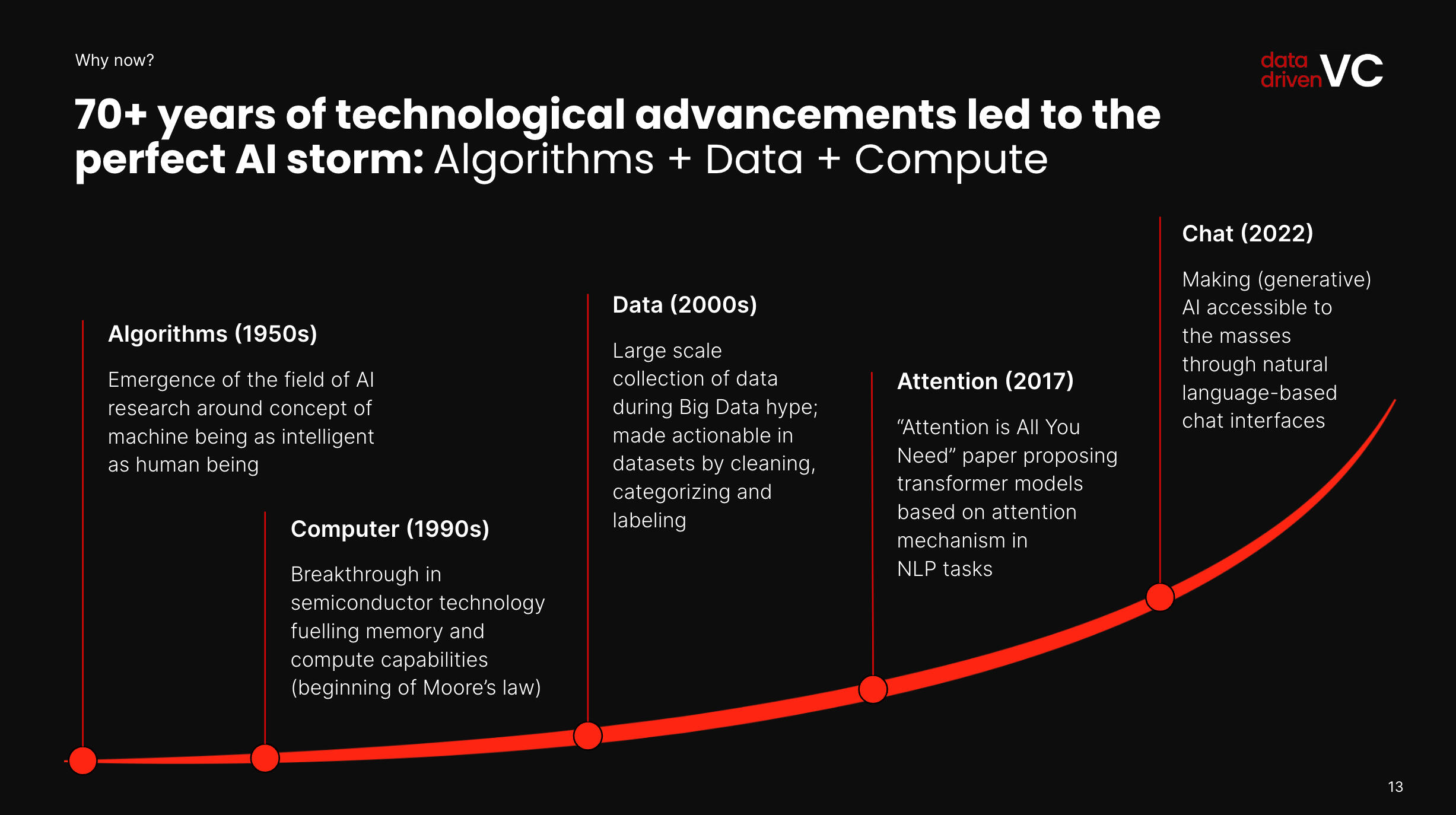

The attention around ChatGPT accelerated the adoption of DDVC initiatives as it enabled junior staff to perform at a higher level and increased productivity by 40%, allowing funds to do more with less.In addition, alternative data sources have decreased in cost and VC fund competition has tightened up, narrowing the window for funds to gain a competitive edge in the market and stay ahead of the curve.

03.

Market Benchmarking

VC funds are increasingly adopting DDVC initiatives & AI around the world.

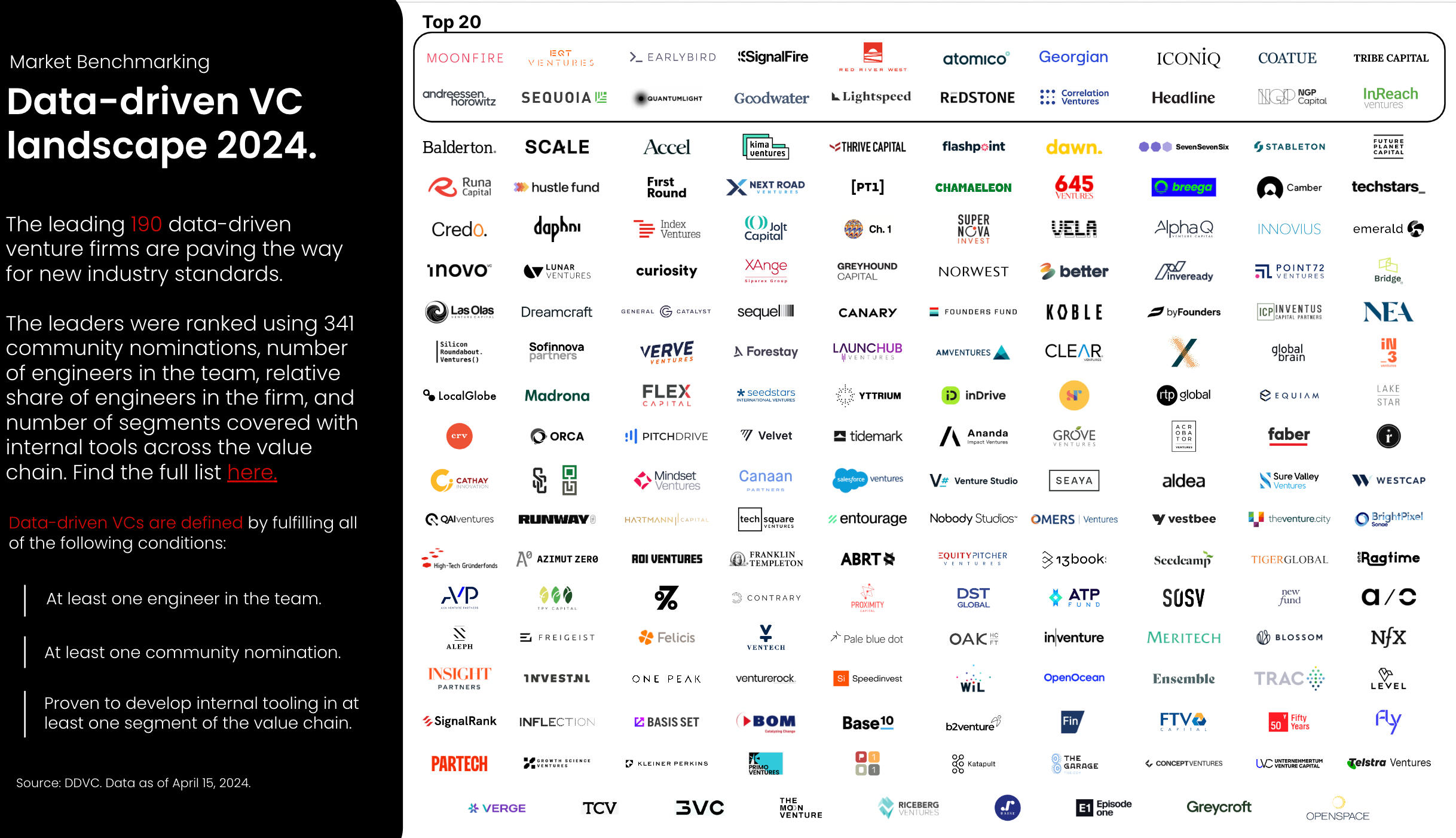

We identified 190 firms leading the VC transformation.

We analyzed these firms and drew a range of conclusions, all of which are included in the report.Our major learnings are:1) AUM per employee scales efficiently in funds, especially in engineering teams;2) It’s still day one as DDVCs continue to significantly expand their budgets for engineering HR and external tooling;3) A third of DDVCs believe that AI allows them to cut headcount in their investment teams in the near future.These and many more deep dives into DDVCs are explored in the report!

We are still at the beginning of the data-driven revolution, with only about 1% of funds around the world are considered DDVCs with dedicated initiatives.

04.

How to become more data-driven?

Behind the DDVC revolution are visionary people, many of whom are sharing their knowledge with our community. We compiled the Top 100 data-driven VC thought leaders globally through a combination of community nominations, content activity, and position in their respective firms.

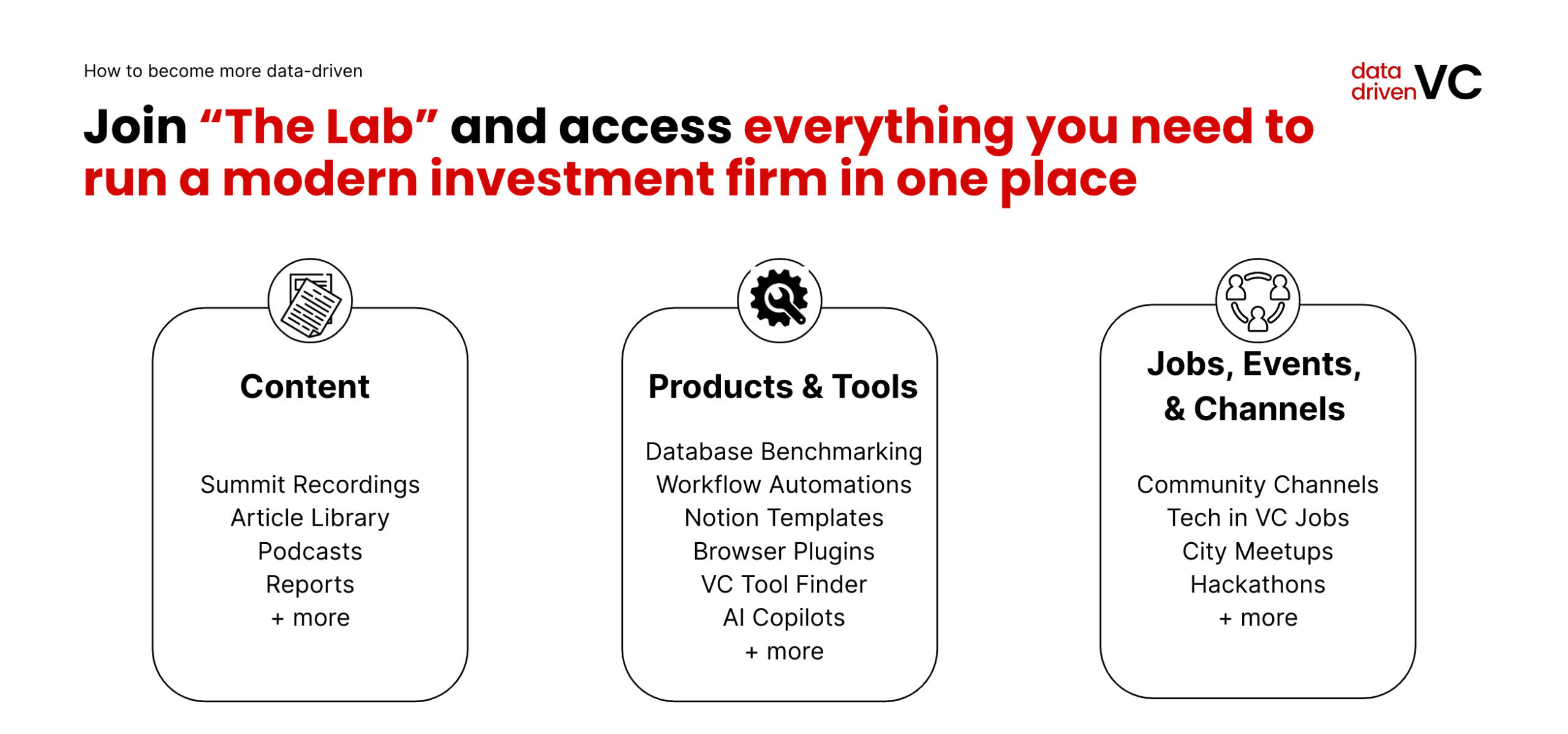

With over 400 tools available for investors to start their data-driven journey, over 50% of VCs state finding the right tools as their main challenge. Therefore, we decided to take a step further in providing actionable steps for the community and are excited to launch:“The Lab”: Access everything to run a modern investment firm in one place.Find out more about our content, products & tools, and community in the report.

Conclusion

The VC world fuels groundbreaking tech ventures, yet it's ironically one of the least digitized industries. Talk of fancy tools and AI is ubiquitous, but actual data-driven approaches are a rare breed. It is becoming increasingly clear that the winners in the market will be the ones truly leveraging internal DDVC initiatives.Looking at the vanguard of data-driven VC, we see a dance between off-the-shelf solutions and custom in-house tools. It's the differentiating IP and the smart combination of external and proprietary internal data, the heart of their tech stack, that gives these firms long-term alpha. This need for a competitive edge is why few openly discuss their strategies, creating an opaque industry ripe for exaggeration.This report cuts through the noise and provides tangible steps for firms to start their digitization journey. We'll shine light on the leaders, team structures, value chain focus, tool stacks, budgets, and a lot more.It's open-source thinking in a closed-source industry.Let's shatter the status quo and propel VC towards a future that's more efficient, effective, and inclusive.Stay driven,

Andre

Access the full report for free

© Data-driven VC. All rights reserved.